Marlin Biweekly 2 Dev & Community Updates – February 2022

Here are the latest developments for the second half of February!

Here are the latest developments for the second half of

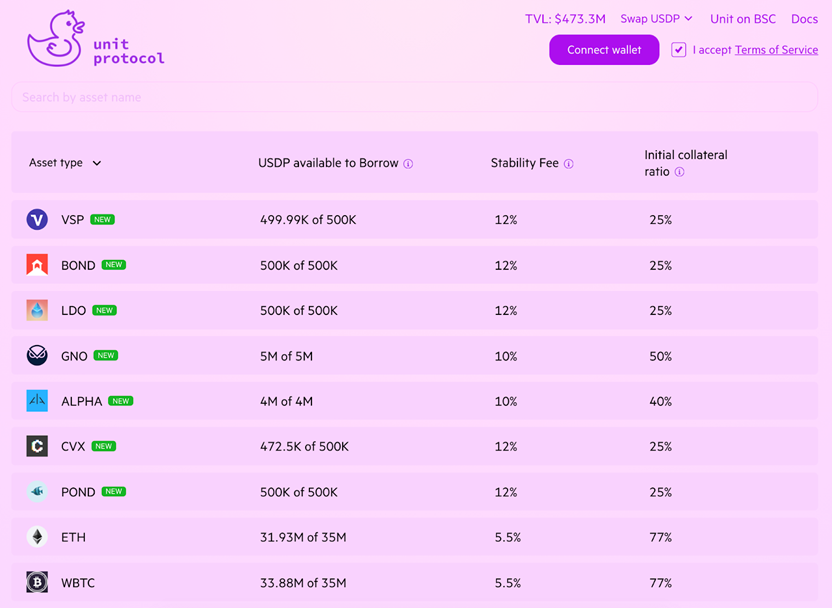

DAOs involve a large number of token owners, many of whom are interested in keeping the tokens for the long-term. However, such a move often locks up capital which can be used for other purposes. This opportunity cost has traditionally been addressed by collateralizing assets to obtain loans. Famously, the MakerDAO protocol has provided such opportunities to owners of virtual assets. Unfortunately, Maker only supports a limited number of tokens as collateral. This is where Unit Protocol comes in.

Unit opens up collateralization and issuance of USDP stable coins to a wide variety of protocols. USDP has largely maintained its dollar-peg for the last few months, can be exchanged to other popular stable coins via Curve and is only eligible for CRV-farming rewards (yes, a Yearn pool exists as well).

It, thus, gives us great delight to share that POND can now be collateralized to mint USDP.

Steps to collateralize POND are fairly simple.

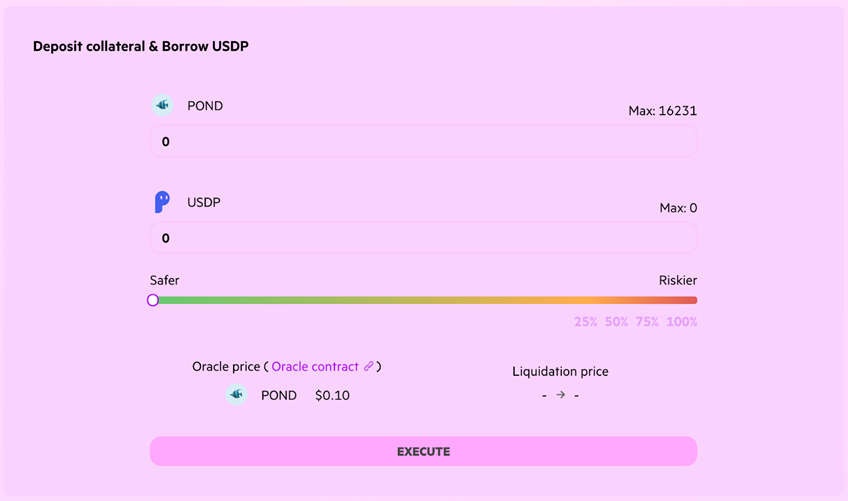

Step 1: Go to https://unit.xyz/POND and connect your wallet via Metamask or WalletConnect. You will be able to see your token balances including that of POND an USDP.

The Initial collateralization ratio of 25% means that for every $100 worth of POND collateralized, you will be able to borrow a maximum of 25 USDP.

A liquidation ratio of 26% implies that once the dollar value of POND collateralized (as reported by the oracle) drops to 100/26 times the amount of USDP minted, the collateralized POND will be eligible for liquidation by a liquidator who is incentivized by 17% of the collateral as liquidation fee.

While Unit provides unlocks new potential for POND owners, it also costs. A 12% stabilization fee if levied annually which under the current setup goes towards buying and burning Unit’s native token DUCK.

Step 2: Scroll below to the section titled ‘Deposit collateral & Borrow USDP’.

You will be able to choose the amount of POND you wish to collateralize up to a maximum of what you own in the connected account. Based on the amount of POND collateralized, you will be shown the maximum amount of USDP you can mint. It is not necessary to mint the maximum amount of USDP possible. In fact, keeping it much lower is recommended to avoid accidental liquidation. Based on your choices, you will be shown the price at which you will be liquidated (under Liquidation price) if you do not top up your collateral with additional POND.

Step 3: Click execute. You will be presented with two transactions, one to approve the contract to access your POND balance and the next to actually deposit POND and mint USDP. Updated balances will soon reflect in your account.

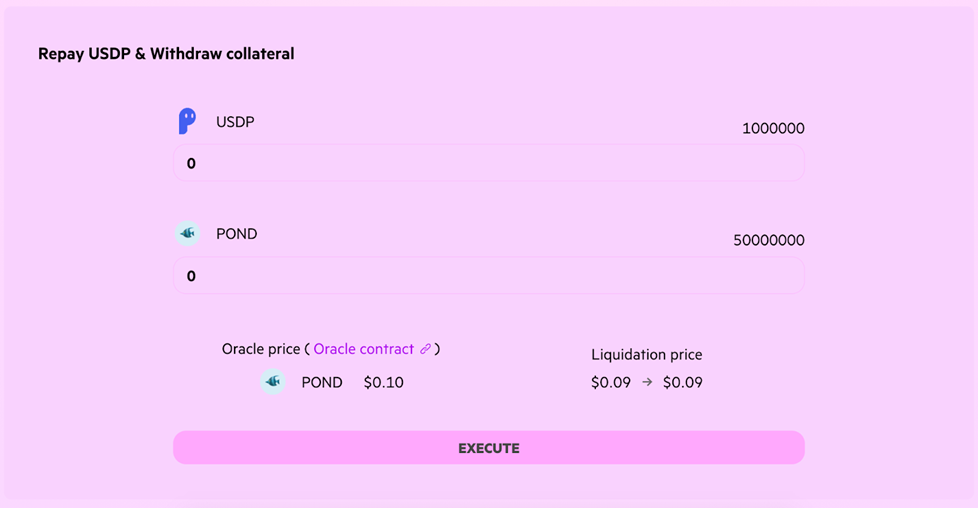

Step 4: You can repay the USDP and/or withdraw collateralized POND using options in the section titled ‘Repay USDP & Withdraw collateral’.

Note that you repay USDP without withdrawing collateral or withdraw collateral without repaying borrowed USDP provided the liquidation price is not hit. Such actions can be useful with fluctuations in the price of POND.

You can use the USDP in any way you wish - either to make payments directly in USDP or to exchange them to other stables (USDC, USDT or DAI), to buy ETH/BTC or to add liquidity to the Curve pool to farm CRV.

Hope you are as excited about this collaboration as we are. It certainly adds to the number of use cases supported by POND and unlocks opportunities unavailable before. As always, feel free to seek assistance on Discord.

Follow our official social media channels to get the latest updates as and when they come out!

Twitter | Telegram Announcements | Telegram Chat | Discord | Website

Subscribe to our newsletter.